Educated Rally School Scotland 1 / 2 of & Full Go out Silver Rally Feel

UncategorizedBlogs

Main banking institutions around the world is actually notably broadening its gold reserves, which have China leading it strategic move. For the past a couple of years, China provides brought in around 700 metric a great deal of gold in the British, tripling gold’s express in foreign reserves to 8%. Such stress offer beyond merely monetary issues, that have diplomatic relationships breaking down across the numerous fronts. The new ensuing uncertainty features caused of a lot organization people to boost their gold allocations while the a profile diversifier and you can geopolitical hedge. The new intensification away from trading issues, such as amongst the Us and you will Asia, have heightened trader nervousness and you may shared notably to help you gold’s desire.

You will find a method volatility in the enjoy, which means advantages will be house fairly often. The fresh jackpot prize will be granted when nine Scatters house, and certainly will commission 5,00 minutes your choice. Obtain the current financial information, knowledge and you may specialist study from our award-profitable MoneyWeek party, to understand what extremely issues when it comes to your money.

Best Cutting edge ETFs

Because of the next damage in the monetary and (geo)political requirements, the new design’s speed target away from simply more USD 4,800 towards the end from 2030 was felt a conventional projection. From this history, also gold, and therefore turned into more pricey this past year, has been low priced. Profit-getting has influenced bulls, having first support during the $2,857 – the brand new retracement height (23.6%) of your own November lowest for the current checklist highest – holding fimr already.

Newest News

One of the recommended how to become sure a position have a tendency to work for you would be to play the free demo types. That it, alongside understanding expert ratings similar to this, will assist you to improve better money when you’re promising a good carefully enjoyable sense. Therefore i’ve offered you a way to play Gold Rally for free. When it comes to just how much gold to hold inside a collection, Stevenson implies to 5-10% is a good matter – that’s a comparable since you might hold in bucks. The new S&P five hundred gained to 4% on the two training after that announcement, while the fears away from a major international downturn or a good You recession subsided.

That was the way it is inside all the about three levels interesting speed cuts as the change of the 100 years. Although not, a central lender’s gold supplies casino superior reviews are also a term away from a nation’s financial pros. The new Shine central lender, NBP, such, now has all in all, 420 tonnes of silver supplies, over the united kingdom. Inside European countries, the economical (power) harmony are much more moving forward away from West in order to East. Costs are still somehow beneath the rising prices-adjusted listing from better above $3,100 for each and every troy oz hit-in 1980 and several analysts state the current rally shows there’s a company floor under the speed. Weary of the identical fate befalling him or her, other non-west central financial institutions features reevaluated its commitment to buck reserves while the the fresh start of Russia’s invasion of Ukraine, and you can bought right up a lot of platinum as an alternative.

- Main financial institutions inside the emerging economies, such as Russia, China, Asia and Turkey had been broadening its holdings as the monetary drama, in which believe regarding the balance of your own buck-recognized economic climate is actually shaken.

- Business audiences often ascribe an increase like this to rising cost of living, concerns in the governmental instability or even the endless insanity of your own nuts-eyed goldbug.

- It has led to increased economic and industry chaos, leading to rising need for secure retreat assets such both silver and gold, that has seen a-1.3% jump recently too.

- As a result the newest rare metal tends to take advantage of highest consult such minutes, tend to operating price development.

Certain commentators have charged the brand new proceed to broadening expectations of All of us rate of interest cuts, which may make low-yielding resource relatively more attractive. The expense of silver has increased 7 percent in just over a week to hit checklist highs, leaving longtime field audience incapable of establish what could have been one of your own red metal’s most interested rallies. Considering Bullion Container, a British-centered precious metal marketplaces, buyers don’t visualize you to definitely febrile ecosystem dissipating the coming year. Moreover, the outlook away from silver hitting the price objective of your own $step three,100 level is probably if hopes of continued Given reducing hold. The newest chronic geopolitical instability and you may a great dovish Fed laws lengthened down rates, however the simple people to have silver are nevertheless good.

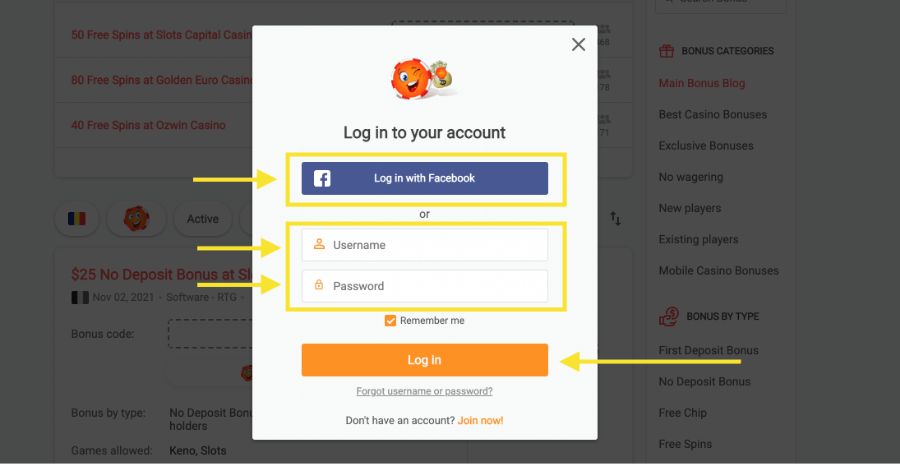

It’s well worth listing one to Europe ‘s the simply remaining part that have y-t-d outflows. The only way to play the Silver Rally position video game to own real cash during the Gambling enterprise.com British should be to register your bank account making a deposit playing with all accepted fee tips. As the cash is moved, you will not only be able to wager real cash, you could allege their Welcome Bundle and have some good bonuses. While the details are frequently updated, you should check out the Promotions page the latest added bonus now offers. More powerful gold rates had been along with driven from the shopping purchases away from jewellery, pubs and you can coins. Poland’s main lender governor Adam Glapiński inside 2021 had established plans to purchase one hundred numerous gold in the a quote to increase the nation’s financial defense, based on regional media account.

The new proportion out of central banking institutions you to definitely anticipate gold to experience a slightly otherwise rather reduced role has fell from twenty-four% to 13%. Not one central financial now needs main financial silver holdings to fall from the year ahead. Similarly, bullion audiences will always aware of the new buck and plan action in the You Federal Set-aside. Economic rules reducing and interest rate cuts indicate gold is far more attractive as the a non-producing advantage. A more powerful buck in addition to influences the expense of gold, because it’s higher priced to own international people so request is slip. A 3rd key factor ascending silver prices last year, when i watched conventional pubs of silver solution $1m for the first time, might have been broadening demand of central banking institutions; such as individuals who manage low-West developing economies.

Today on the let you know, Katie Martin and you will Rob Armstrong unpack silver’s go up. Whether or not this is the beginning of the a continual the newest gold-rush or simply just another cyclical upswing is still around viewed, but for today, investors and central banking companies the same try gaming huge on the bullion. That’s so good for a product who’s nothing basic explore and you can doesn’t produce money otherwise spend interest to those one to wait.

Can i play Silver Rally which have real cash?

Normally, in the event the focus of one’s silver prediction try long term up coming analysis of the basics, web browser scientific research, relates to the newest fore. To your action present in current months, the new You.S. stock market try declining for the an expected Springtime stage base, with Gold today joining regarding the decline. Each one of these locations appear to have next to perform just before troughing, even though our company is to the window to own an option base… Silver surged above $step three,3 hundred since the estimated as to what appears to be a blowoff better. The present day cycle is actually estimated so you can level between April sixteenth and you will 23rd, recommending rates you may greatest people go out. Our cycle investigation points to a short-label level in the future months, followed closely by a potential retest of your own $step 3,100 top within the Summer.

Although expectations of Us interest rate incisions were injury back in recent months, silver went on so you can roar high. The new gold reserves from Italy and you will France has for each and every grown inside worth from the around $85bn (£65) in the last 2 yrs. An option basis about gold’s bullish development is the unmatched rate away from requests from the central lender. Certainly one of private miners, Gold-fields, and this works in australia, Ghana, Peru, and you can Southern area Africa, are upwards forty two% in 2010 and could end up being positioned to split from a 30-year change variety, according to the Organization View’s Andrew Addison. “Don’t want to miss which, while the GFI boasts the greatest foot of every silver stock,” he writes, when you’re indicating you to definitely people get offers for the pullbacks to $18 of a current $19, in the expectation from a change over $20. These rates step has been characterised by a few high levels and better lows on the intraday maps, verifying the effectiveness of the fresh uptrend.

Escalating geopolitical stress operating safer-retreat demand

Thus far, 2025 has proceeded this type of trend, and you can inspite of the temporary breaks for the tariffs, there is nevertheless many suspicion along the a lot of time-name mindset for trading and the around the world savings. The newest rally within the silver continues on which have rates hitting a most-time high on Thursday — and there’s space for it to go up more because the main financial institutions always get bullion inside list quantity. The degree of All of us rates is an important rider out of coming gold costs.